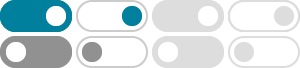

Understanding Overdraft: Fees, Types, and Protection Options

Aug 19, 2025 · Learn about overdraft fees, types, and protection options. Understand how banks cover your transactions even with insufficient funds and avoid costly penalties.

Know your overdraft options - Consumer Financial Protection Bureau

Jun 4, 2025 · An overdraft occurs when you don’t have enough money in your account to cover a transaction, and the bank or credit union pays for it anyway. You then have to pay back the amount …

Overdraft Services for Personal Accounts - Wells Fargo

Learn about Overdraft Protection and overdraft services that can cover your transactions if you don’t have enough available money in your account. See how you can avoid overdrafts and overdraft fees.

8 Best Banks for Overdrafts of 2025 - NerdWallet

Nov 18, 2025 · These picks from NerdWallet have no overdraft fees and offer ways to cover overdrafts when they do happen.

Overdraft Protection | Definition, Purpose, How It Works, Benefits

Nov 17, 2025 · The primary purpose of overdraft protection is to prevent accounts from being overdrawn. This means ensuring that account holders do not go into a negative balance, which can …

Overdraft options and fees FAQ - USAA

Looking to understand USAA overdraft options and fees? Find answers to frequently asked questions about our overdraft protection service.

Overdraft Account: Meaning, Interest Rate, Bank Overdraft Eligibility

Jul 18, 2025 · Overdraft (OD) is a credit facility in which the money can be withdrawn from the current or savings account, even if the account balance is zero or even below. Overdraft facility is a type of …

Overdraft Service FAQs: Limits, Fees, Settings & More

Looking to change overdraft settings or sign up for overdraft protection? Find answers to your frequently asked questions and learn about the limits, settings and fees associated with overdraft services at …

Overdraft Protection Services - No Fee Coverage | Discover

Set up Overdraft protection by linking a qualifying Discover® account that can provide backup funds when your checking account is overdrawn. When your account is overdrawn, we’ll automatically …

Capital One 360 Checking Overdraft Options | Capital One

As a Capital One customer, you can choose whether or not to enroll in an overdraft option. If you were enrolled in Next Day Grace, you’ve been automatically converted to the no-fee overdraft option.